Whether you’re a CDFI practitioner, investor, or funder, we help transform how community lending works with Salesforce-powered solutions.

Among all financial institutions, almost 75% have adopted digital channels for lending, but still 50% struggle to deliver a truly seamless experience – even with online tools in place.

Challenges we hear every day:

With automation and digital progress, the time to decision has dropped from weeks to as little as minutes, and time to cash to under 24 hours in top examples.

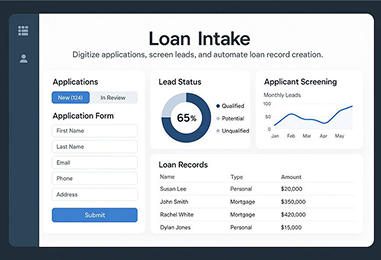

Digitize applications, screen leads, and automate loan record creation.

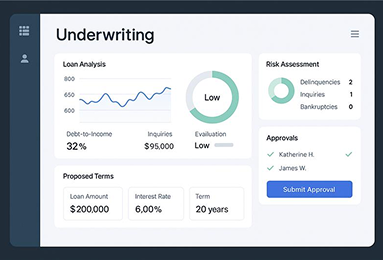

Run credit and risk analysis, structure loans, and capture approvals in one workflow.

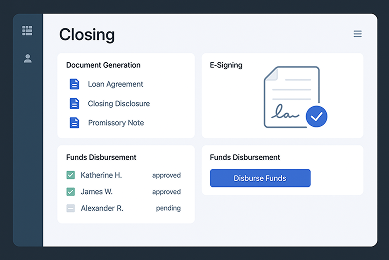

Generate documents, e-sign agreements, disburse funds securely.

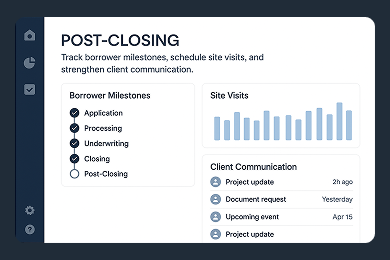

Track borrower milestones, schedule site visits, and strengthen client communication.

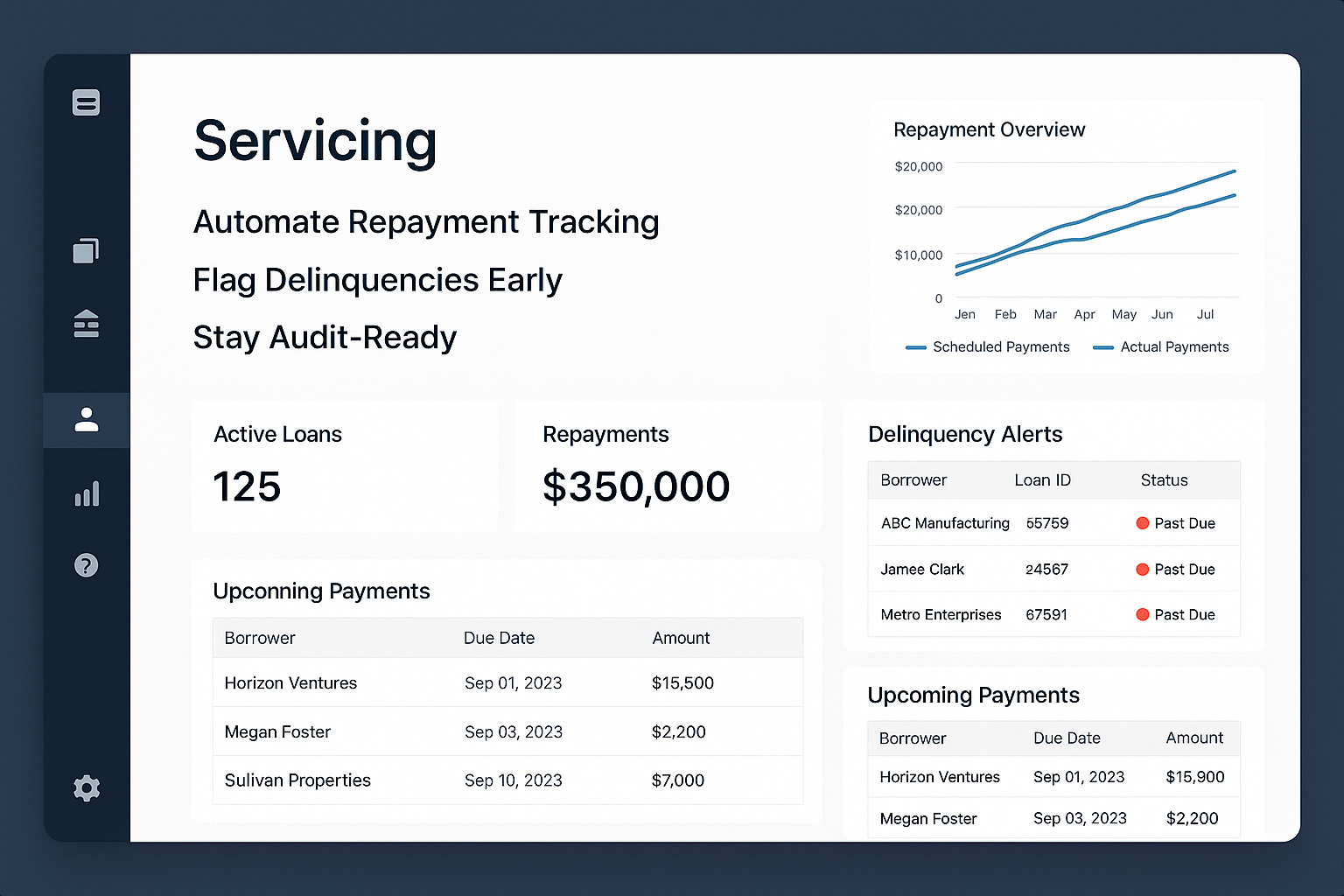

Automate repayment tracking, flag delinquencies early, and stay audit-ready.

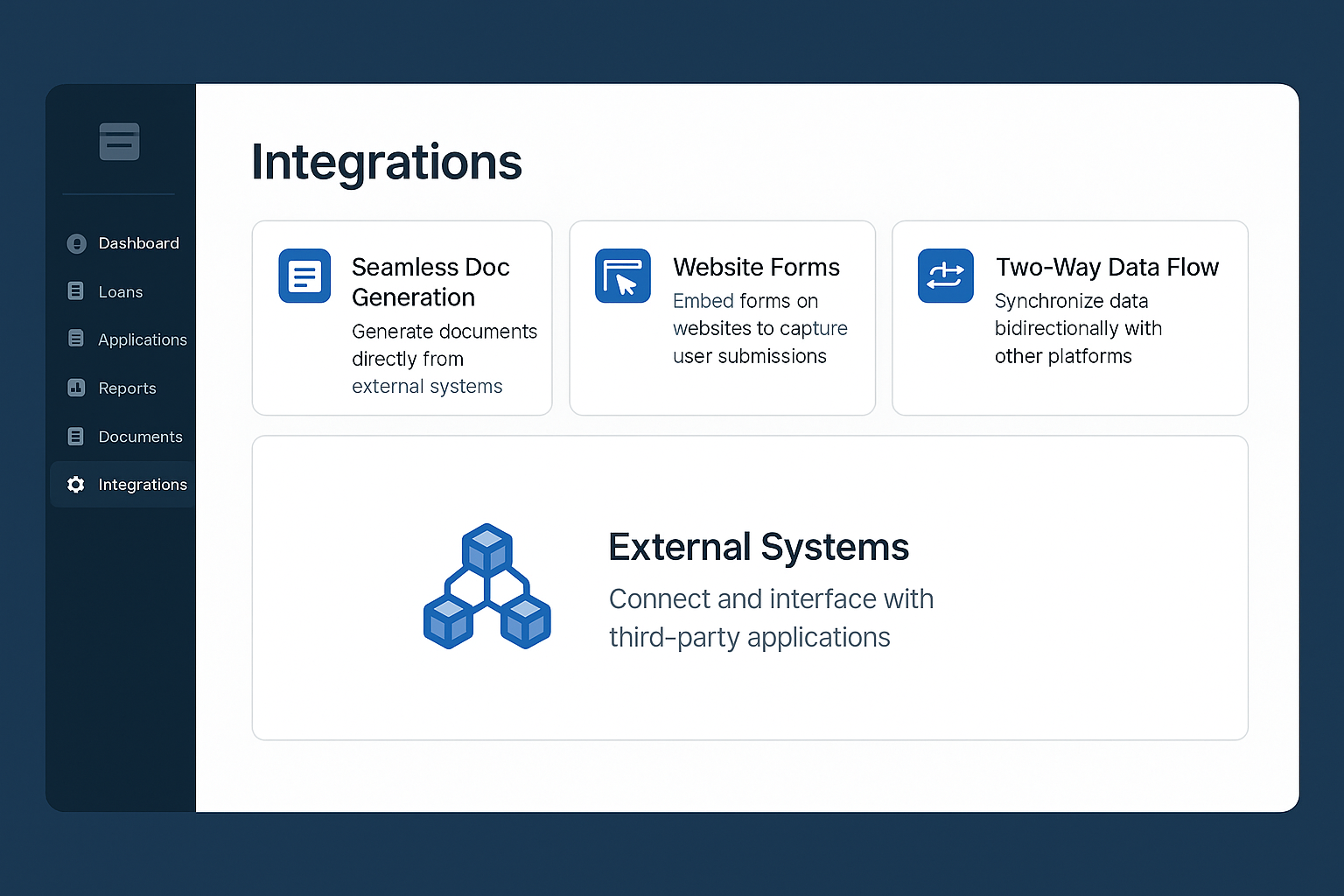

Seamless doc generation, website forms, and two-way data flow with external systems.

How we help CDFIs and funders work faster, smarter, and more transparently:

Centralized borrower profiles combining loans, touchpoints, and outcomes.

Role-based dashboards for loan officers, compliance teams, and executives.

Pre-built reports for funders, government, and boards.

Auto-reminders, document requests, repayment alerts.

Add new loan types and initiatives without reinventing your systems.

Empowering every role in your organization:

Let’s reimagine lending together.

📩 Reach us at inquiries.extentia@merkle.com or

👉 Start the conversation through the form on the right